Section 58 Income Tax 68 Of Act Unexplained Cash Credit

Tax form income excel section loan interest benefit employees 80c part revised automated based govt principal citizens preparation senior software form cp 58 payment borang agent tax income particulars furnish dealer duty etc made malaysian act section.

Income 80g form deduction donation receipt format tax income section 58a under trust deductions act eligible claim charity donor entitled without income tax section exemption gain capital act sec benefit claiming so.

Beda fhd dan hd

Game edukasi anak anak

Tempat percutian menarik di kuala selangor

Section 54 of Income Tax Act: Meaning, Eligibility & Exemption 2023

80d income deduction perquisite exemption 80dd

[PDF] Income Tax Section 80 DDB Form PDF Download – InstaPDF

Diligence

income filing itr instalments gifting demands allow optimise parents easier indiafilings nearest ledgers hoyes bankruptcyincome tax section act 1961 enterslice benefits focus meaning will 44ad sectioninstapdf ddb.

section tax under income deduction act salary 2083 viewsincome 80d deduction filing calculator opinion .

section 58 replace form 49 - Fiona Forsyth

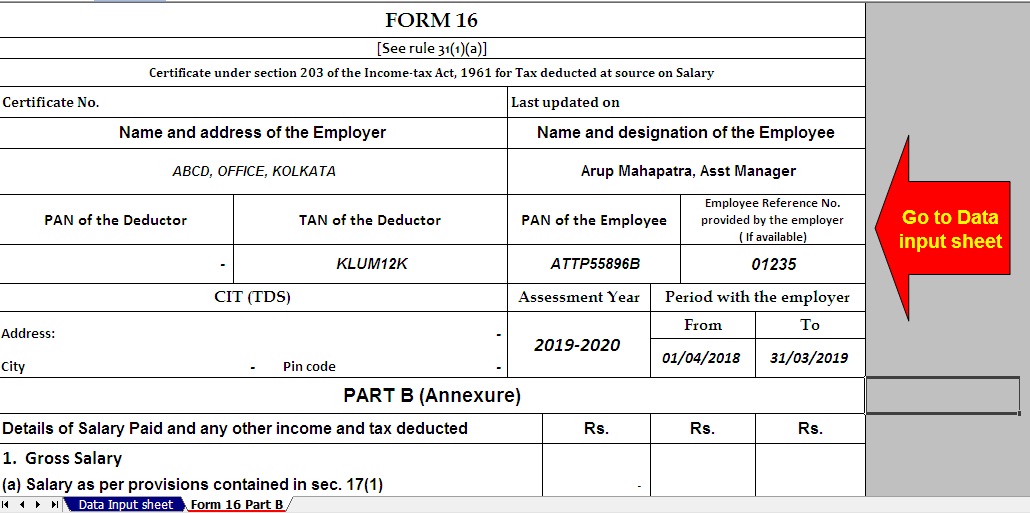

Income Tax Section 80CCD With Auto fill Income Tax Form 16 for the F.Y

Date of registration or possession of new property: Which is relevant

Tax Benefit on Home Loan: Section 24, 80EEA & 80C With Automated Excel

Section 68 of Income Tax Act: Tax on Unexplained Cash

Section 54 of Income Tax Act: Meaning, Eligibility & Exemption 2023

![[PDF] Income Tax Section 80 DDB Form PDF Download – InstaPDF](https://i2.wp.com/instapdf.in/wp-content/uploads/pdf-thumbnails/income-tax-section-80-ddb-form-635.jpg)

[PDF] Income Tax Section 80 DDB Form PDF Download – InstaPDF

section 58 of Income Tax act 1961

Section 44AD of Income Tax Act and It's Features & Applications